‘Springtime tax scams target young and vulnerable’, warns HMRC

Young adults who may have less experience of the tax system should be especially vigilant against springtime refund scams, warns HM Revenue and Customs (HMRC).

Scammers are increasingly targeting vulnerable or elderly people and those with less familiarity with the tax system, such as young adults.

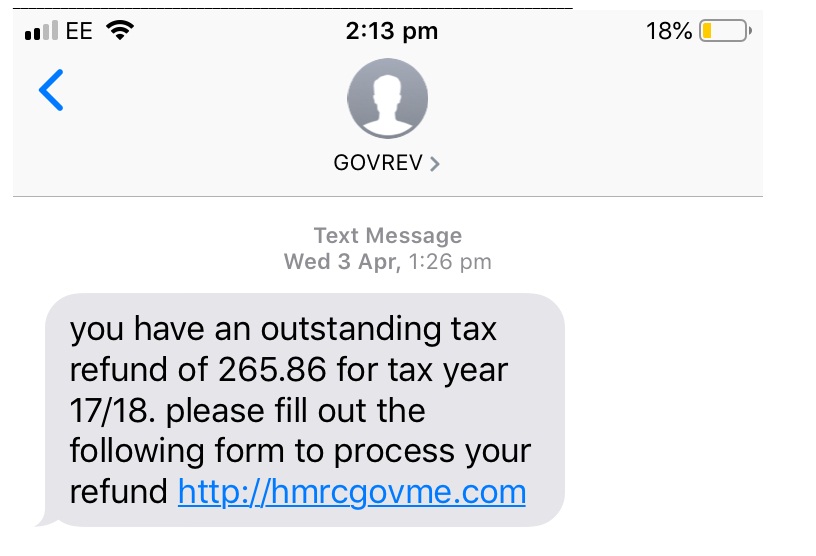

During April and May, fraudsters regularly blitz taxpayers with refund scams by email or text pretending to be HMRC. Criminals do this to coincide with legitimate rebates being processed by HMRC.

They will encourage people to provide bank details, in exchange for a payment worth hundreds of pounds, on a fake government website to harvest private information and steal money. HMRC will never ask someone to provide bank details by text or email.

Last Spring alone, HMRC received around 250,000 reports of tax scams — which is nearly 2,500 a day — and requested that over 6,000 phishing websites be deactivated.

Head of Customer Services at HMRC, Angela MacDonald, said, “We are determined to protect honest people from these fraudsters who will stop at nothing to make their phishing scams appear legitimate.

“HMRC is currently shutting down hundreds of phishing sites a month. If you receive one of these emails or texts, don’t respond and report it to HMRC so that more online criminals are stopped in their tracks.”

Head of Action Fraud, Pauline Smith, said, “These criminals will contact victims in many ways including spoof calls, voicemails and text messages.

“People should spot the signs of fraud and be wary of emails with attachments which might contain viruses designed to obtain personal or financial information.”

When taxpayers file returns to HMRC, they will then legitimately receive a tax calculation as well as an email promoting them to check their Personal Tax Accounts. As many taxpayers file Self Assessment returns, most of HMRC’s contact happens in the months after January.

If you have paid too much tax, HMRC will issue the repayment automatically either direct into your bank account or if you have indicated on your return there is no bank account then HMRC will send you a cheque.

If you have not paid enough tax, HMRC will tell you how much you owe and how you can pay securely.

Short URL: https://newrytimes.com/?p=66552